Methodology change | Solactive Top 10 US Technology Index | Effective Date 28/08/2019

Today, on the 26/08/2019, Solactive announces the following changes to the methodology of the following Indices (the ‘Affected Indices’):

Solactive Top 10 US Technology Index PR (ISIN: DE000SLA8PB2)

Solactive Top 10 US Technology Index NTR (ISIN: DE000SLA9GX3)

Solactive Top 10 US Technology Index TR (ISIN: DE000SLA9GY1)

Rationale for methodology change

Solactive has determined that the current guideline lacks clarity in the definition of a “Business Day”. In detail, since the index constituents consist solely of US stocks, public holidays in the US on which the New York Stock Exchange is not open for general business are not considered “Business Days”. This detail is now explicitly stated in the guideline.

Furthermore, to improve the comprehensiveness of the guideline, certain technical elements were translated into descriptive statements. The content of the paragraphs in question remains the same.

Changes to the Index Guideline

The following changes are made in the Index guideline with respect to the following point:

- Section 4, definition of “Business Day”.

From:

“A “Business Day” is any weekday from Monday through Friday.”

To:

“A “Business Day” is any weekday from Monday through Friday. A day on which the New York Stock Exchange is not open for general business is not a Business Day.”

- Section 2.1, step 2.

From:

“Each security receives a score calculated as the percentile rank of the Performance Score subtracted by the percentile rank of the Volatility Score”

To:

“Each security receives a score combining the Performance Score and the Volatility Score”

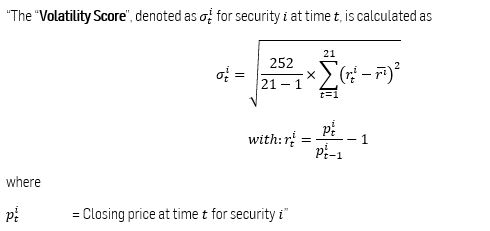

- Section 4, definition of “Volatility Score”.

From:

To:

“The “Volatility Score” is the annualized price return volatility of the respective security of the company in the Index Universe over the previous month.”

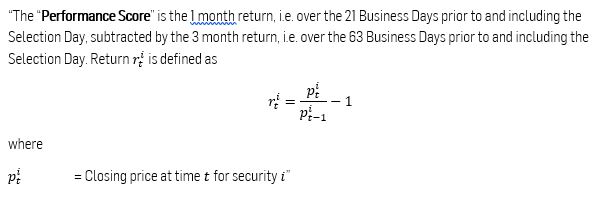

- Section 4, definition of “Performance Score”.

From:

To:

“The “Performance Score” is the combination of the 1 month price return and the 3 month price return of the respective security of the company in the Index Universe.”

Defined terms used in this announcement, but not defined herein, have the meaning assigned to them in the respective index guideline of the Affected Indices.