Methodology Change | Solactive ISS-ESG Global Low Carbon Custom Index| Effective Date 2024-07-08

Today, on the 24/06/2024, Solactive announces the following changes to the methodology of the following index (the ‘Affected index‘):

| NAME | RIC | ISIN |

| Solactive ISS ESG Global Low Carbon Custom Index PR | .SOGLOWCP | DE000SL0BPX2 |

| Solactive ISS ESG Global Low Carbon Custom Index NTR Solactive ISS ESG | .SOGLOWCN | DE000SL0BPY0 |

| Solactive ISS ESG Global Low Carbon Custom Index TR | .SOGLOWCT | DE000SL0BPZ7 |

Rationale for Methodology Change

Solactive has determined that the index receives its value proposition from the identification of sustainability leaders out of a Global Market Universe.

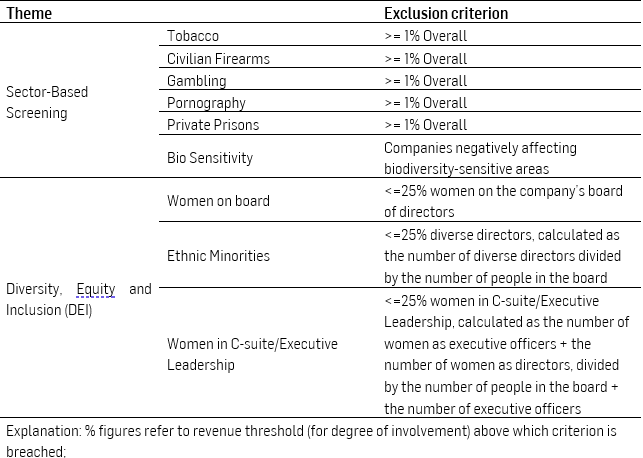

Due to the evolving market standards for sustainability, Solactive proposes to align the index methodology by strengthening its ESG focus by adding additional ESG screens. The additional screens can be distinguished between Sector-Based and Diversity, Equity and Inclusion screens. An exhaustive breakdown can be found below.

Based on the data as of the last selection day 2024-04-04, the intended change would reduce the number of constituents in the index from 1243 to 400.

To ensure sufficient diversification of the index despite the reduced number of constituents, a relative weight cap of 5% compared to the weights in the Index Universe is intended.

Changes to the Index Guideline

The following Methodology changes will be implemented in the following points of the Index Guideline (ordered in accordance with the numbering of the affected sections):

2.2 SELECTION OF THE INDEX COMPONENTS

From:

Based on the Index Universe, the initial composition of the Index as well as any selection for an ordinary rebalance is determined on the Selection Day in accordance with the following rules:

- Companies classified in the sector “ENERGY” or in the industries “Chemicals: Agricultural”, “Chemicals: Major Diversified”, or “Chemicals: Specialty” are removed.

- China A Shares are removed.

- Select securities with carbon emissions intensity, calculated as sum of scope 1, scope 2, and scope 3 carbon emissions divided by revenue, lower than the median carbon emissions intensity in the respective sector. The median carbon emissions intensities per sector are calculated based on the securities remaining after step 1. Carbon emissions intensities are provided by the DATA PROVIDER. All companies for which an evaluation of this selection step is not possible due to insufficient and/or missing information or data are excluded.

(the “INDEX COMPONENT REQUIREMENTS“) The selection of the INDEX COMPONENTS is fully rule-based and the INDEX ADMINISTRATOR cannot make any discretionary decision.

To:

Based on the Index Universe, the initial composition of the Index as well as any selection for an ordinary rebalance is determined on the Selection Day in accordance with the following rules:

- Companies classified in the sector “ENERGY” or in the industries “Chemicals: Agricultural”, “Chemicals: Major Diversified”, or “Chemicals: Specialty” are removed.

- China A Shares are removed.

- Solactive evaluates all companies in the respective Index Universe based on the criteria outlined in the table below. The evaluation is based on data provided by the Data Provider:

All companies violating any of the criteria in the Sector-Based Screening are excluded. US companies violating any of the criteria in the Diversity, Equity and Inclusion Screening are excluded. Non-US companies violating the women in C-suite/Executive Leadership criteria in the Diversity, Equity and Inclusion Screening are excluded. The country allocation is based on the GBS country classification. All companies for which an evaluation of these exclusion criteria is not possible due to insufficient and/or missing information or data are excluded.

(the “Index Component Requirements“)

The selection of the Index Components is fully rule-based and the Index Administrator cannot make any discretionary decision.

2.3 Weighting of the Index Components

From:

On each SELECTION DAY each INDEX COMPONENT is assigned a weight according to FREE FLOAT MARKET CAPITALIZATION.

To:

On each Selection Day each Index Component is assigned a weight according to Free Float Market Capitalization. The maximum weight deviation from the weight in the INDEX UNIVERSE is capped at 5%. The excess weight is distributed across Index Components with a weight below 5% pro-rata in an iterative manner until all the remaining Index Components have a maximum weight of 5%.

Defined terms used in this announcement, but not defined herein, have the meaning assigned to them in the respective index guideline of the Affected Indices. The amended version of the index guideline will be available on the effective date.