Methodology Change | Elwood Blockchain Index | Effective Date 18/07/2021

Today, on the 12/07/2021, Solactive announces the following changes to the methodology of the following Indices (the ‘Affected Indices’):

|

NAME |

RIC |

ISIN |

|

Elwood Blockchain Global Equity Index |

.BLOCK |

DE000SLA6ZB5 |

|

Elwood Blockchain Global Equity PR Index |

.BLOCKP |

DE000SLA6ZC3 |

Rationale for Methodology Change

Solactive has determined that the current liquidity and size criteria do not allow for the potential future growth in the blockchain sector. The new methodology ensures a robust selection process across a wide range of benchmarked AUM. It is specifically structured to accommodate growth by adding stocks from the top of the BCS tiering to maximize blockchain exposure and allowing for a variable number of constituents (40-75) such that low-scored companies are only added if required. The above will mostly be accomplished via a weighting scheme which incorporates the indexed assets as of selection day to calculate a maximum weight for all potential index members.

Changes to the Index Guideline

The following Methodology changes will be implemented in the following points of the Index Guideline (ordered in accordance with the numbering of the affected sections):

- The wording in Section 1.5 of the index guideline is replaced by the following wording:

From (old version):

“[…]

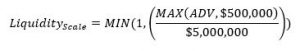

Index Components are weighted based on their Blockchain Category Score and their Liquidity Scale, where Liquidity Scale is defined as follows:

Where:

ADV = 6-months Average Daily Value Traded as defined under section 2.1 of the index guideline.

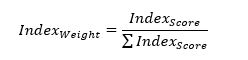

An Index Score is calculated as the Blockchain Category Score times the Liquidity Scale. The index weight of each Index Component is the percentage of each individual company’s Index Score relative to the total sum of all Index Scores from all Index Components:

To ensure UCITS eligibility, all index weights are capped at 5% with any excess weight above this level distributed pro-rata to any index component with a weight below 5%. This process is repeated until no individual index component has a weight greater than 5%.

[…].”

To (new version):

“[…]

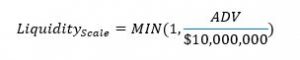

Index Components are weighted based on their Blockchain Category Score and their Liquidity Scale, where Liquidity Scale is defined as follows:

Where:

ADV = 6-months Average Daily Value Traded as defined under section 2.1 of the index guideline.

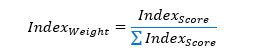

An Index Score is calculated as the Blockchain Category Score times the Liquidity Scale. The index weight of each Index Component is the percentage of each individual company’s Index Score relative to the total sum of all Index Scores from all Index Components:

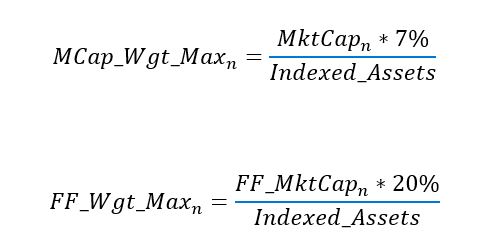

To ensure that (a) the index remains compliant with the diversification requirements for UCITS funds, and (b) the shares of any index constituent company that are held by products tracking the index do not represent an excessive proportion of either that company’s total outstanding shares or its free float shares, a stock-specific index weight cap (Max_%Wgtn) is calculated for each stock n in the index:

And where MktCapn is the total market capitalisation in USD of company n, FF_MktCapn is the free float market capitalisation in USD of company n, and Indexed_Assets is the total USD value of assets benchmarked to the index as of the Selection Date as defined in Section 4.

The weight of each security n is capped at Max_%Wgtn, with any excess weight above this level distributed pro-rata to any index component with a weight below its Max_%Wgtn. This process is repeated until no individual index component has a weight above its Max_%Wgtn.

[…].”

- Section 2.1. – Selection of the Index Components

From (old version):

“[…]

In order to be eligible for inclusion into the index, companies rated as Core (Blockchain Category Score 5) or Significant (Blockchain Category Score 4) need to have an Average Daily Value Traded of USD $ 100,000 over the past 6-months, including the Selection Day.

Companies rated as Moderate (Blockchain Category Score 3), Developing (Blockchain Category Score 2), or Potential (Blockchain Category Score 1) need to have an Average Daily Value Traded of USD $ 250,000 over the past 6-months, including the Selection Day.

[…].”

To (new version):

“[…]

In order to be eligible for inclusion into the index, companies rated as Core (Blockchain Category Score 5) or Significant (Blockchain Category Score 4) need to have an Average Daily Value Traded of USD $ 250,000 over the past 6-months, including the Selection Day.

Companies rated as Moderate (Blockchain Category Score 3), Developing (Blockchain Category Score 2), or Potential (Blockchain Category Score 1) need to have an Average Daily Value Traded of USD $ 1,000,000 over the past 6-months, including the Selection Day.

[…].”

- Section 4: Definitions – Index Universe

Wording Added:

“[…]

The Index Advisor will also provide a quarterly statement of the total USD value of assets benchmarked to the Index based on the most recent data available to the Index Advisor as of the Selection Day (“Indexed Assets”). This value is then used to calculate the percentage weighting caps used in section 2.1.

[…].”

Defined terms used in this announcement, but not defined herein, have the meaning assigned to them in the respective index guideline of the Affected Indices. The amended version of the index guideline will be available on the effective date.