Aging Population: France’s Credit Rating Downgraded

Fiscal Worries Due to an Aging Population

Aging populations across the developed world seem to already negatively impact public finances, The recent rise in interest rates due to inflation has exacerbated this issue by increasing the cost of pensions and healthcare. Rating agencies Moody’s, S&P, and Fitch all forecast that credit ratings will worsen without drastic reforms, creating a cycle of increased fiscal burdens and borrowing costs. This shift is largely due to demographic changes, with a rapidly increasing proportion of people entering retirement age, thereby reducing the working population and heavily increasing the burden on public finances.

Interest rate hikes by the US Federal Reserve, European Central Bank, and Bank of England have increased government debt servicing costs to their highest level since the financial crisis. This situation has serious implications for the EU, Japan, and the US, where an aging population is expected to drive increased healthcare and pension costs. According to a stress test conducted by S&P Global Ratings, a one percentage point increase in borrowing costs could increase debt-to-GDP ratios by 40-60 percentage points by 2060. S&P also estimates that by 2060, the typical government could run a deficit of 9.1% of GDP, up from 2.4% in 2025, if no reforms are implemented to ease the fiscal pressure of aging populations.

Demographic profiles indicate central and southern European countries, particularly Germany, are experiencing rapid aging, causing strain on labor markets and potential growth. Rating agencies have also flagged the structural deficit of the pension system in Spain and France, while – on the flip side – praising Greece for its sweeping pension reforms implemented after its debt crisis. Conversely, several Asian countries, including Korea, Taiwan, and China, also face deteriorating outlooks due to similar demographic pressures.

A Closer Look at Demographics: From Pyramid to Pillar

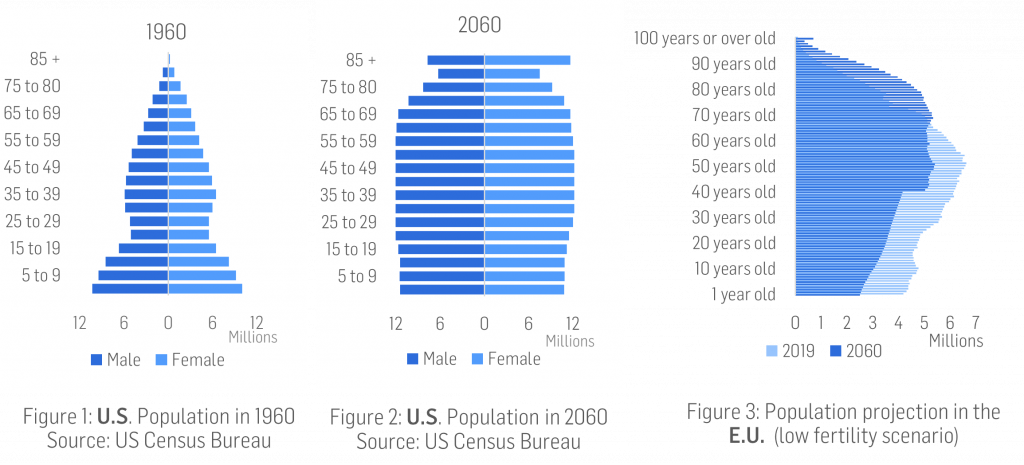

Let’s take a closer look at how the demographics of the European Union and United States should look like (in a ‘healthy’ scenario), and what they actually look like. For the first time in the history of the developed world, elders over 65 already outnumber children under five years old. By 2030, they will outnumber children under ten. By 2035, there will be more people over 65 than teens under 18 years old (source: US Census Bureau and Eurostat).

If we plot a given population, with the horizontal axis representing the total number of people and the vertical axis representing their age, the graph of a healthy population should, in theory, resemble a pyramid (Figure 1): young people would considerably outnumber old people. Such was the case for humanity’s entire history, and for the animal kingdom as well. Yet, our reality is starting to look different: we are moving from a pyramid shape to a straight, vertical pillar, with old people having the same numbers as young people (Figure 2). The World Bank even suggests an inverted pyramid within the next few decades.

According to official consensus data, the proportion of US citizens over 65 is projected to double by 2060. In Europe, the population over 65 is expected to expand by 60.5% until 2050. In Japan, people over 65 already constitute 29% of the entire population and are forecasted to further grow percentage-wise. In China, elders currently represent 13% of the population, but are expected to reach 35% of the population by 2060 due to the one-child policy. In other words, elders are expected to represent an unprecedentedly large share of the developed world’s (and China’s) population by 2050.

The non-elder adult population can’t keep up with these numbers. In 2010, there were seven potential caregivers (non-senior adults) for each person in the high-risk group of people over 80 years old. By 2030, there will only be four potential caregivers, and by 2050, only three potential caregivers for every person over 80 years old. In other words, we are also headed straight into a care crisis by 2050.

Problem or Opportunity? Welcome to the Dawn of Age-Tech.

As aforementioned, these demographic trends could result in a deep crisis in the upcoming decades, placing great stress on the pension and healthcare systems, on the working population, and ultimately on the global economy. On the other hand, problems foster opportunities, and the prospect of a crisis may simply leave us with no choice but to reimagine elderly care and introduce innovative, transformative solutions. Unsurprisingly, the answer still lies with technology as the biggest potential game-changer, with new digital healthcare solutions promising to bring costs down, free up human caregivers, improve care quality, and ultimately create a more sustainable model. Did you know that here is something of a “space race” already happening today within this niche subindustry, in which both start-ups and tech giants participate?

We are talking about Age-Tech, which represents technology specifically developed with elders in mind: AI driven fall detection, digital pill dispensers, smart sensors, preventive medicine, and even care-robots. Age-Tech can improve the autonomy and life quality of elders while saving time and reducing costs for caregivers. For example, decision-making algorithms enabled by big data and AI can learn patters and detect unusual activity such as wandering behavior, falls, and disturbances in the frequency of sleep or bathroom visits, and which can play a vital role in detecting the earliest possible signs of certain common medical conditions that seniors are prone to develop – working best in conjunction with wearable technology monitoring vital signs and predicting medical problems. One example among many others of such technology is SafelyYou – which is already boasting to have reduced falls by 40% and hospital visits by 80%!

Age-Tech could be seen as a fresh new spin on sectors like home automation, telemedicine, wearables, autonomous driving, digitization, and AI – all from the perspective of elderly care, exclusively. If a care crisis is coming, it will act as a key growth driver for these investment themes: a massive scale rollout of such tech will not just be possible – it will be necessary. Read our full report on the Future of Elderly care here!